What is PCI DSS

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards formed in 2004 by Visa, MasterCard, Discover Financial Services, JCB International and American Express. Governed by the Payment Card Industry Security Standards Council (PCI SSC), the compliance scheme aims to secure credit and debit card transactions against data theft and fraud.

While the PCI SSC has no legal authority to compel compliance, it is a requirement for any business that processes credit or debit card transactions. PCI certification is also considered the best way to safeguard sensitive data and information, thereby helping businesses build long lasting and trusting relationships with their customers.

PCI DSS Certification

PCI certification ensures the security of card data at your business through a set of requirements established by the PCI SSC. These include a number of commonly known best practices, such as:

- Installation of firewalls

- Encryption of data transmissions

- Use of anti-virus software

In addition, businesses must restrict access to cardholder data and monitor access to network resources.

PCI-compliant security provides a valuable asset that informs customers that your business is safe to transact with. Conversely, the cost of noncompliance, both in monetary and reputational terms, should be enough to convince any business owner to take data security seriously.

A data breach that reveals sensitive customer information is likely to have severe repercussions on an enterprise. A breach may result in fines from payment card issuers, lawsuits, diminished sales and a severely damaged reputation.

After experiencing a breach, a business may have to cease accepting credit card transactions or be forced to pay higher subsequent charges than the initial cost of security compliance. The investment in PCI security procedures goes a long way toward ensuring that other aspects of your commerce are safe from malicious online actors.

PCI DSS Compliance levels

PCI compliance is partitioned into four levels, in view of the yearly number of credit or debit card transactions a business cycle. The grouping level figures out how an enterprise needs to stay agreeable.

PCI compliance is separated into four levels, in light of the yearly number of credit or debit card transactions a business cycle. The arrangement level figures out how a venture needs to stay consistent.

- Level 1: Applies to vendors handling in excess of 6,000,000 genuine credit or debit card transactions every year. Directed by an approved PCI auditor, they should go through an internal audit once a year. Moreover, when a quarter they should submit to a PCI examine by a Approved Scanning Vendor (ASV).

- Level 2: Applies to vendors handling somewhere in the range of one and 6,000,000 genuine credit or debit card transactions yearly. They’re expected to finish an evaluation once a year utilizing a Self-Assessment Questionnaire (SAQ). Furthermore, a quarterly PCI scan might be required.

- Level 3: Applies to traders handling somewhere in the range of 20,000 and 1,000,000 E-commerce transactions every year. They should finish a yearly evaluation utilizing the pertinent SAQ. A quarterly PCI scan may likewise be required.

- Level 4: Applies to traders handling less than 20,000 E-commerce transactions every year, or those that interaction dependent upon 1,000,000 certifiable transactions. A yearly evaluation utilizing the important SAQ should be finished and a quarterly PCI scan might be required.

PCI DSS Prerequisites

The PCI SSC has framed 12 prerequisites for dealing with cardholder information and keeping a protected organization. Circulated between six more extensive objectives, all are important for an enterprise to become consistent.

Secure Organization

- A firewall configuration must be introduced and kept up with

- System passwords should be unique (not merchant provided)

Secure Cardholder Data

- Stored cardholder information should be secured

- Transmissions of cardholder information across open organizations should be encoded

Vulnerability Management

- Anti-virus software should be utilized and consistently refreshed

- Secure frameworks and applications should be created and maintained

Access Control

- Cardholder information access should be restricted to a business need-to-know basis

- Every individual with PC access should be doled out an unique ID

- Physical access to cardholder information should be confined

Network monitoring and Testing

- Access to cardholder information and organization assets should be followed and observed

- Security frameworks and cycles should be consistently tried

Data Security

- A Policy dealing with information security must be maintained

What is PCI DSS

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security requirements developed by Visa, MasterCard, Discover Financial Services, JCB International, and American Express in 2004.

the Payment Card Industry Security Standards Council (PCI SSC), the compliance scheme protects credit and debit card transactions from data leakage and fraud.

Despite the fact that the PCI SSC has no legislative authority to compel compliance, it is a requirement for any company that processes credit or debit card transactions.

PCI certification is also considered to be the best way to safeguard sensitive data and records, enabling businesses to establish long-term and trusting relationships with their clients.

PCI DSS certification

PCI certification guarantees the security of card information at your business through a bunch of necessities laid out by the PCI SSC. These incorporate various normally known accepted procedures, for example,

- installation of firewalls

- Encryption of information transmissions

- Use of anti-virus software

In addition, organizations must restrict access to cardholder data and screen access to arrange assets.

PCI-compliant security gives a significant resource that illuminates clients that your business is protected to execute with. Alternately, the expense of resistance, both in financial and reputational terms, ought to be sufficient to persuade any entrepreneur to truly take information security.

A data breach that reveals delicate client data is probably going to have extreme repercussions on a venture. A break might bring about fines from payment card issuers, claims, reduced deals and a severely Damaged Reputation.

In the wake of encountering a break, a business might need to stop accepting credit card transaction or be compelled to pay higher ensuing charges than the underlying expense of safety consistence. The interest in PCI security procedures goes quite far toward ensuring that different parts of your business are protected from malevolent web-based entertainers.

Blog By: Priyanka Rana

18

FebPCI DSS

Feb 18, 2023Recent Blog

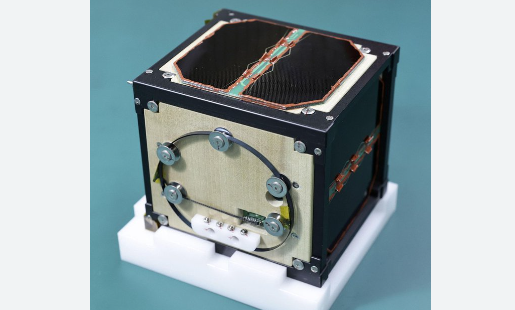

The ‘LignoSat’Nov 12, 2024

India’s First Writer’s VillageOct 28, 2024

The First Tri-Fold Of SamsungOct 24, 2024

India’s New Spam Tracking SystemOct 23, 2024

ICC T20 Women’s World Cup Winner 2024Oct 22, 2024