Blog By: Priyanka Rana

RBI State of the Economy Report (March 2024)

The Reserve Bank of India (RBI) released its ‘State of the Economy’ report in March 2024, providing insights into the country’s economic performance and outlook. The report, authored by RBI staffers, including Deputy Governor M D Patra, highlighted the need for monetary policy to remain in a risk-minimizing mode to guide inflation towards the 4% target. It also underscored an upward trend in per capita income, citing data from the Household Consumption Expenditure Survey (HCES).

Inflation and Monetary Policy

The report noted that the recurring incidence of short-amplitude food price pressures is hindering a more rapid decline in headline inflation towards the 4% target. Despite the softening of core inflation, which has been broad-based and among its lowest prints in the series, food price pressures have capped the headline inflation’s downward trajectory.

The CPI readings for January and February 2024 showed that the winter easing of vegetable prices was shallow and short-lived, while cereal prices maintained strong momentum, and prices of meat and fish registered a surge. Consequently, the report emphasized that monetary policy must remain in a risk-minimization mode, guiding inflation towards the target while sustaining the momentum of growth.

Demand and Consumption

On the demand side, the report observed that private final consumption expenditure remained low, despite the third quarter coinciding with the festival season. However, shifts in per capita income indicate a robust demand outlook for premium consumer businesses. The HCES information revealed that per capita spending on durables and discretionary products has been rising in both rural and urban markets, with real per capita income increasing 1.5 times since 2011-12 at a compound annual growth rate (CAGR) of 4%.

21

MarRBI State of the Economy Report (March 2024)

Mar 21, 2024Recent Blog

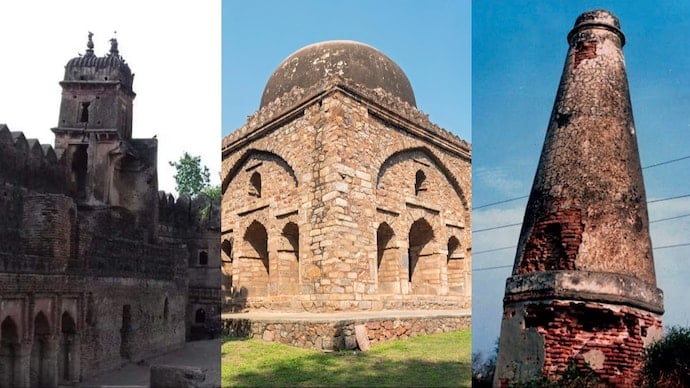

When Monuments Delisted !!Apr 08, 2025

The Frontier Technologies Readiness IndexApr 07, 2025

Vikram 3201 & Kalpana 3201Apr 04, 2025

The Open Weight Language ModelApr 03, 2025

Asia Cup 2025Apr 02, 2025